مصر تستهدف زيادة إنتاج النفط 9% العام المالي المقبل

تستهدف مصر زيادة إنتاجها من النفط الخام بنحو 9% خلال العام المالي المقبل (2024-2025)، ليصل إلى 637 ألف برميل يومياً

آخر الأخبار

سوديك ونوبو يعلنان عن مشروع جديد بمنطقة شرق القاهرة

أخر تحديث منذ 22س11دتراجع جماعي لمؤشرات السوق بختام تعاملات الأربعاء تحت ضغط مبيعات المصريين

أخر تحديث منذ 22س58دسيمنس موبيليتي وحسن علام تفوزان بعقد إشارات خط سكة حديد الإمارات عمان

أخر تحديث منذ 2024/04/24 01:46:00 موزير الصناعة يبحث مع شركات أجنبية خطط انشاء مشروع مشترك لإنتاج سيانيد الصوديوم بمصر

أخر تحديث منذ 2024/04/24 11:53:00 صتوقعات بتجاوز صادرات كوفي كاب لتصنيع الكابلات الكهربائية 200 مليون دولار بحلول 2027

أخر تحديث منذ 2024/04/24 10:54:00 صمدبولي يُكلف بإعلان تاريخ مُحدد لدُخول الشحن الجوي ضمن منظومة الشحن المُسبق

أخر تحديث منذ 2024/04/24 09:16:00 صمدبولي يُكلف بإعلان تاريخ مُحدد لدُخول الشحن الجوي ضمن منظومة الشحن المُسبق

أخر تحديث منذ 2024/04/24 09:08:00 صالحكومة تفاوض هوج النرويجية لاستئجار وحدة تغويز

أخر تحديث منذ 2024/04/24 08:51:00 صمصر تستهدف زيادة إنتاج النفط 9% العام المالي المقبل

أخر تحديث منذ 2024/04/24 08:37:00 صالمركزي يسحب 461 مليار جنيه من سيولة البنوك هذا الأسبوع

أخر تحديث منذ 2024/04/23 02:29:00 متراجع جماعي لمؤشرات السوق بختام تعاملات الأربعاء تحت ضغط مبيعات المصريين

أنهت البورصة المصرية جلسة تعاملات اليوم الأربعاء على تراجع جماعي في حركة المؤشرات؛ حيث أغلق المؤشر الرئيسي للسوق إيجي إكس 30

المشرق مصر يتعاون مع Visa لإطلاق بطاقة Mashreq NEO Visa المبتكرة

أعلن بنك المشرق – مصر ("المشرق مصر")، بالتعاون مع الشركة الرائدة عالميًا في مجال المدفوعات الرقمية ("فيزا")، عن إطلاق بطاقة Mashreq NEO Visa

سوديك ونوبو يعلنان عن مشروع جديد بمنطقة شرق القاهرة

أعلنت كل من سوديك، شركة التطوير العقاري الرائدة في مصر، ونوبو، العلامة التجارية العالمية الشهيرة في ع

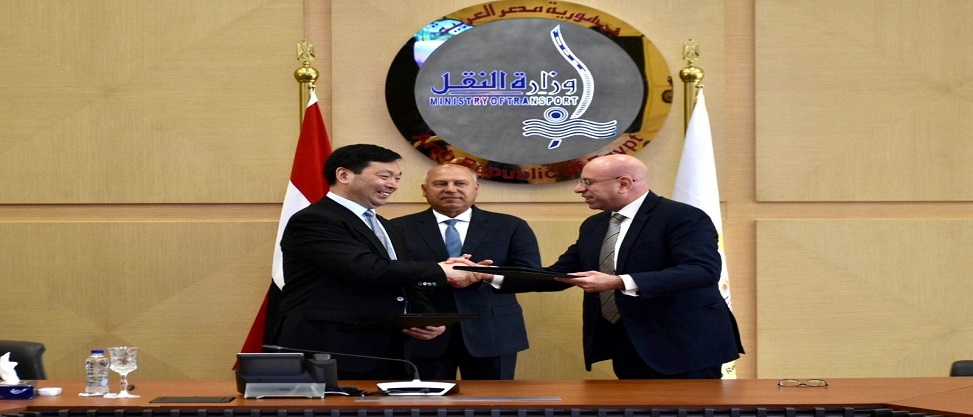

الملاحة الوطنية تتعاقد على بناء سفينتين جديدتين من سفن الصب الجاف مع ترسانة هانتونج الصينية

شهد الفريق مهندس كامل الوزير، وزير النقل، توقيع عقد بناء سفينتين جديدتين من أحدث سفن الصب الجاف النظيف بين شركة الملاحة الوطنية

الأكثر قراءة

| مؤشر | قيمة | يوم | أسبوع | شهر | 3 شهور | 6 شهور | سنة | منذ بداية العام |

|---|---|---|---|---|---|---|---|---|

| TAMAYUZ | 7,993.63 | 7,993.63 (% 0) | 7,757.41 (% 3.05) | 6,977.16 (% 14.57) | 6,851.80 (% 16.66) | 5,211.23 (% 53.39) | 3,491.39 (% 128.95) | 6,531.40 (% 22.39) |

| EGX30 TR | 11,102.64 | 11,102.64 (% 0) | (-8.18 %) 12,091.68 | (-11.21 %) 12,503.99 | (-5.74 %) 11,778.87 | 9,827.20 (% 12.98) | 7,286.75 (% 52.37) | 10,859.31 (% 2.24) |

| EGX70 EWI | 5,997.17 | 5,997.17 (% 0) | (-7.8 %) 6,504.19 | (-10.82 %) 6,724.52 | (-8.91 %) 6,584.00 | 4,317.40 (% 38.91) | 2,991.93 (% 100.44) | 5,640.68 (% 6.32) |

| EGX30 Capped | 31,652.40 | 31,652.40 (% 0) | (-8.78 %) 34,698.76 | (-11.47 %) 35,751.50 | (-6.58 %) 33,883.44 | 28,701.25 (% 10.28) | 20,933.88 (% 51.2) | 30,887.48 (% 2.48) |

| EGX100 EWI | 8,510.24 | 8,510.24 (% 0) | (-8.08 %) 9,257.92 | (-11.33 %) 9,597.15 | (-8.69 %) 9,319.83 | 6,555.21 (% 29.82) | 4,549.74 (% 87.05) | 8,111.12 (% 4.92) |

| EGX30 | 25,917.59 | 25,917.59 (% 0) | (-8.52 %) 28,332.65 | (-11.68 %) 29,344.46 | (-6.32 %) 27,666.18 | 23,131.96 (% 12.04) | 17,516.04 (% 47.96) | 25,501.94 (% 1.63) |

| الدولة | مؤشر | قيمة | التغير | نسبة التغير % | الأدني | الأعلى | الافتتاح |

|---|---|---|---|---|---|---|---|

| البحرين | BIX | 2017.95 | 2.17 | 0.11 | 2017.99 | 2011.74 | 2013.12 |

| السعوديه | KSA | 12377.45 | 21.76 | 0.18 | 0 | 0 | 0 |

| ابو ظبى | ADX | 9051.14 | 6.11 | 0.068 | 0 | 0 | 9045.03 |

| دبى | DFM | 4176.3 | 6.75 | 0.16 | 4187.86 | 4166.6 | 4167.33 |

| الكويت | KWT | 5929.78 | 12.41 | 0.21 | 5943.97 | 5923.79 | 5933.22 |

| الفضه - الذهب/ قيراط | شراء | بيع |

|---|---|---|

| أونصة الذهب - عالميًا | 2,325.60 | 2,325.20 |

| عيار 24 عالميًا- دولار أمريكي | 74.68 | 74.77 |

| عيار 24 - السوق المحلي | 3,565.36 | 3,513.93 |

| عيار 21 - السوق المحلي | 3,120.00 | 3,075.00 |

| عيار 18 - السوق المحلي | 2,674.29 | 2,635.71 |

| الفضة - السوق المحلي | 43.50 | 38.50 |

| الصنف | السعر | يومي | شهري | سنوي |

|---|---|---|---|---|

| سلفات النشادر 20.6%/ طن | 8,548.00 | -2.4 % | 3.1 % | 14.7 % |

| نترات النشادر 33.5% مخصوص/طن | 11,644.40 | -1 % | -1.2 % | 27.5 % |

| اليوريا 46.5% مخصوص/طن | 11,569.80 | -1.3 % | -4.3 % | 14.1 % |

| الصنف | السعر | يومي | شهري | سنوي |

|---|---|---|---|---|

| الأسمنت الرمادي/ طن | 2,209.00 | -0.4 % | -6.9 % | 6.6 % |

| الحديد الاستثماري/ طن | 41,875.00 | 0.8 % | -13.6 % | 12.1 % |

| حديد عز/ طن | 42,881.30 | 0.8 % | -15.2 % | 10.5 % |

| الصنف | السعر | يومي | شهري | سنوي |

|---|---|---|---|---|

| الأرز المعبأ/ كيلو | 34.5 | 0.4 % | 0.9 % | 47.7 % |

| الدقيق المعبأ/كيلو | 27 | -1.6 % | -8.8 % | 28.7 % |

| السكر المعبأ / كيلو | 41.2 | 3.4 % | -13.9 % | 103.2 % |

| الفول المعبأ / كيلو | 51.7 | -4.5 % | -2.2 % | 41.4 % |

| المكرونة المعبأة / كيلو | 31.6 | 0 % | 1.5 % | 42.2 % |

| زيت عباد الشمس / كيلو | 94.2 | -0.2 % | 0.3 % | 40.6 % |

| الصنف | السعر | يومي | شهري | سنوي |

|---|---|---|---|---|

| الطماطم / كيلو | 11.2 | -6.8 % | 21.3 % | -1.7 % |

| البصل / كيلو | 23.7 | -3.5 % | -18.8 % | 71.1 % |

| البطاطس / كيلو | 15.2 | -0.9 % | 9.1 % | 66.1 % |

| الخيار/ كيلو | 12.8 | -1.9 % | -25.2 % | 25.1 % |

| الليمون / كيلو | 29.3 | -1.4 % | 11.6 % | 20.5 % |

| الصنف | السعر | يومي | شهري | سنوي |

|---|---|---|---|---|

| دواجن بيضاء / كيلو | 89.5 | -2.5 % | -14.4 % | 14 % |

| لحم كندوز / كيلو | 386.5 | -1.1 % | -0.1 % | 39.6 % |

| سمك بلطي / كيلو | 79.6 | -3.6 % | -2.8 % | 22.3 % |

| الصنف | السعر | يومي | شهري | سنوي |

|---|---|---|---|---|

| اللبن المعبأ / لتر | 42.1 | -1.4 % | -0.6 % | 54.5 % |

| كرتونة بيض أبيض | 154.9 | -2.8 % | 2.8 % | 42.2 % |